Auto Insurance coverage Is Required By Law, Study More About It

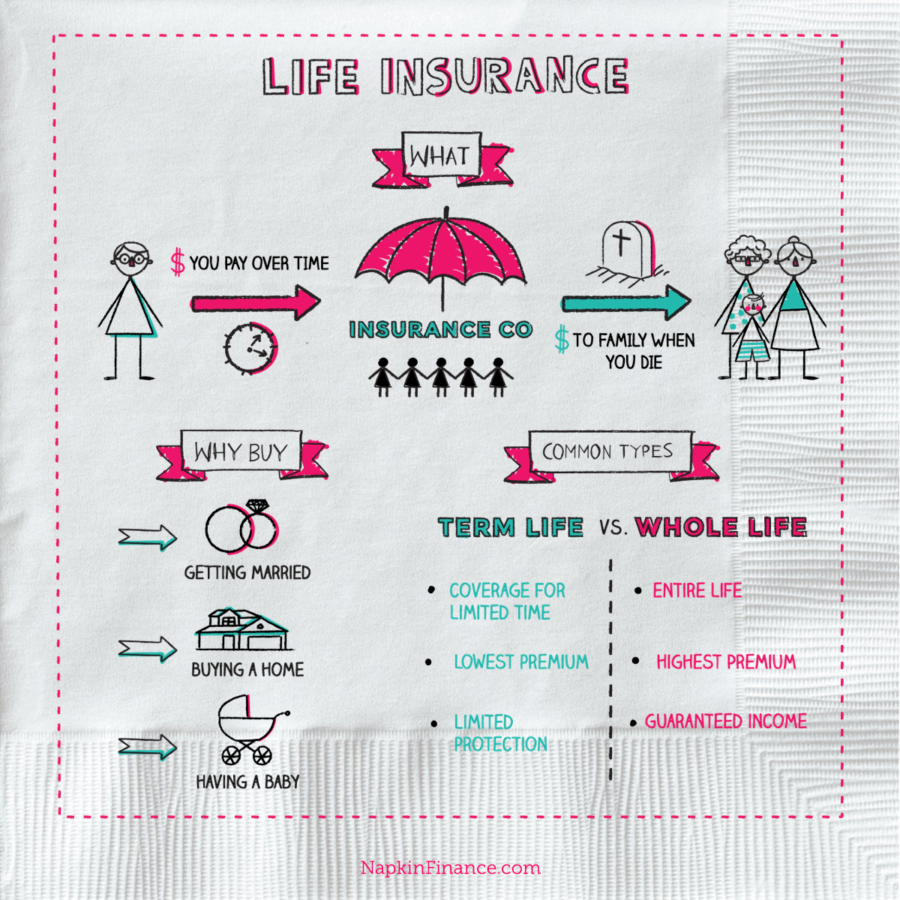

Life insurance is an essential part of monetary planning, however understanding it, and buying the suitable policy could be tricky. There are entire and time period life, riders and convertibility clauses to make sense of, and you then nave to decide on the best one. Listed here are some steps you can take to ensure you get the right policy for the perfect value.

Be certain to get quotes on different levels of insurance policies. Many insurance coverage corporations supply breaks at completely different ranges of protection that could wind up saving you cash. Just because you have determined that 175,000 is all the coverage you need, does not imply you should not get quoted on different ranges simply in case.

Take the time to shop about and examine costs and insurance policies before you buy. A technique to save money is to cost shop utilizing one in all the numerous insurance coverage comparability websites accessible on-line. You could be shocked that some firms are as much as 50% costlier than others. Also, select a policy whose worth takes into account your medical historical past.

Attempt to determine for yourself how a lot life insurance you really want. Many life insurance coverage suppliers offer a number of methods during which they can make their very own estimations. They often over estimate in order to turn a larger revenue. Do your personal estimating to be able to be certain you do not get ripped off.

Do what you may to raised your credit. The decrease your credit score, the upper your month-to-month premiums may presumably be. This is due to the truth that a coverage holder with a low score is seen as a high risk to the insurance coverage firm. That is what causes them to cost the higher premiums. It's to allow them to offset the chance.

Before buying life insurance it will be significant to grasp why you need it. If a dad or mum or partner dies, life insurance money can be utilized to pay for mortgage bills, retirement, or a faculty education. If different folks depend in your earnings for help, it can be wise to take out a life insurance coverage.

When procuring round for a life insurance coverage policy, bear in mind that certain occupations and hobbies are considered dangerous and might increase your premium. A few of these occupations embrace business fishing, logging, helicopter or airplane piloting, and roofing. Even a enterprise executive position will be considered risky if it requires you to journey to certain perilous countries. Hobbies which might be thought of hazardous to your health embody hang-gliding, parachuting, skiing, and motorcycling. Make certain to disclose this data to forestall your claim from being denied if the insurance coverage firm decides to analyze it.

When buying Important Tips on Getting The Life Insurance You Need , a fantastic tip is to not make your insurance coverage planning a sophisticated matter. It's best to aim to keep it so simple as possible. Since life insurance is meant to guard you, the policy you select should be the one which greatest suits your needs.

When purchasing life insurance, it is essential that you simply understand your specific wants. No person is aware of what you want or what your loved ones needs better than you, so take time to assume any policy choice by means of, analyzing the state of affairs from every attainable angle and figuring out what finest matches your specific needs.

Never wait till you actually need the protection. This could lead to desperation and will certainly lead to larger premiums and less of a package deal. And if you've got already encountered a health problem, you might not even have the ability to get a superb coverage.

Determine Keep Your Money In Your Pocket By using The suitable Auto Insurance Tactics of life insurance coverage coverage your individual folks will need in the unlikely occasion of your loss of life. Use one of the numerous obtainable on-line life insurance coverage calculators, or multiply your yearly wage by an element of eight. This is the common debt left when someone passes away. The better your coverage, the higher off your estate.

Be sure to get enough coverage. $500,000 can seem like a windfall of money for your family within the event of your passing. However when you're taking into consideration a $300,000 mortgage, automotive loans, scholar loans, burial and funeral bills, bank card debt and the like, all these can add up fast.

When considering your life insurance needs, decide if multiple insurance policies better suit your life and financial state of affairs. In You will Really feel More Secure With Life Insurance coverage , having a term coverage for unexpected crises can protect a household in the brief-term, whereas including an entire life coverage may present extra lengthy-term protection, and an choice for increasing cash worth in the coverage.

Watch out when considering buying additional riders to a brand new coverage or an current one. Easy methods to Get Essentially the most Out Of Life Insurance may be pushing you to buy further riders just for the good thing about compensation. Until you fully perceive what a rider can do for you, do not buy them. Instead, ask for a second opinion from one other knowledgeable.

Determining when to purchase life insurance is a hard question for many individuals to reply. The perfect recommendation is to plan according to whenever you imagine your dependents will no longer rely on your support. For instance, once your kids are out of faculty they are going to be financially stable and will no longer want as much of your help, so you possibly can plan your insurance coverage with this in mind.

To avoid wasting cash in your life insurance coverage, make adjustments to your policy as your needs grow and change. Good occasions to reevaluate your policy are after getting married or divorced, after having a baby or after gaining care-taking duties for an elderly mum or dad or relative. If you have saved sufficient for retirement and have no one else to take care of, you'll be able to forgo life insurance completely.

Because of the recognition use of the web, it is simpler than ever to shop round and examine insurance policies and corporations. No need to rely on an agent to do all your analysis for you. If you understand what you need, you'll be able to still purchase via an agent, but just tell them the company and coverage you want to to purchase.

As you read, life insurance coverage is incredibly vital to your current and future monetary planning and so is knowing all the different varieties. With this understanding, it makes it easier for you to find out what insurance policies match your personal needs. Following these simple ideas, is a very good starting place.